Best cash ISAs for over 60s: Tailored winners for senior savers

As retirement approaches, finding the best cash ISA for over 60s becomes essential for supplementing pension income with tax-free growth. The top easy access option currently offers 4.51% AER, while fixed-rate deals reach 4.27% AER for one-year terms, according to recent comparisons from MoneySavingExpert. These rates help over 12 million UK seniors preserve their average savings balances exceeding £25,000 against inflation.

Cash ISAs allow up to £20,000 annual tax-free savings in 2025/26, with no age restrictions but particular appeal for those on fixed incomes. Unlike regular savings, interest stays tax-free, shielding earnings from HMRC. For over 60s, this means more reliable income without eroding returns through tax.

Why cash ISAs suit over 60s savers

Cash ISAs provide stability and tax efficiency, ideal for seniors relying on state or private pensions. The core benefit is tax-free interest up to 4.45% for tailored senior accounts, as highlighted by money.co.uk, helping combat rising living costs without basic rate tax deductions.

Tax benefits for pension income

Over 60s often have lower taxable income, but any interest above the personal savings allowance (£1,000 for basic rate taxpayers) incurs tax. Cash ISAs eliminate this, allowing full retention of earnings. For example, on a £20,000 deposit at 4% AER, you’d save around £80 annually in tax compared to non-ISA savings.

Protection and accessibility considerations

All eligible cash ISAs are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per provider. Seniors should prioritise easy access for emergencies, especially with healthcare needs. Providers like Nationwide offer branch access, suiting those less comfortable with online banking.

Comparison to regular savings accounts

Regular savings yield similar rates but tax applies to interest, reducing net returns for over 60s. Cash ISAs also lock in tax-free status for the full term, unlike variable-rate savings that fluctuate with Bank of England base rates. For more on general rates, see our guide to the best cash isa.

Key factors to consider for seniors

When selecting the best rate cash ISA for over 60s, balance liquidity with returns; easy access suits unpredictable expenses, while fixed terms guarantee stability. Inflation at around 2% in 2025 means aiming for rates above this to preserve purchasing power.

Liquidity needs in retirement

Seniors may need quick access for medical bills or travel. Flexible cash ISAs allow withdrawals without penalty, at rates around 4.00% AER per Tembo. Avoid locking funds if emergencies are likely.

In-branch vs online options

For over 60s preferring face-to-face service, high-street banks like Halifax provide the best in-branch cash ISA for over 60s. Online options often yield higher rates but require digital confidence. Check providers for joint accounts with spouses.

Transferring existing ISAs

Switching to better deals is straightforward and preserves tax-free status. The best cash ISA transfer rates for over 60s can boost earnings without restarting the clock. Use services like MoneySavingExpert for guidance on seamless moves.

Tip for seniors: Always verify FSCS coverage and minimum deposits, often £500, before committing. Compare monthly interest options for steady income, like the best cash ISA monthly interest for over 60s.

Top fixed-rate cash ISAs for over 60s

Fixed-rate cash ISAs offer security for risk-averse seniors, with the best fixed cash ISA rates for over 60s at 4.27% AER for one year. These lock your money for a set period, shielding against rate drops.

Best one-year fixed rates

The top one-year fixed rate cash ISA for over 60s from providers like those on moneyfactscompare.co.uk yields 4.27% AER, ideal for short-term planning. Minimum deposits start at £500, with no early access to maintain the rate.

Best two-year fixed rates

For longer security, the best two-year cash ISA rates for over 60s hover around 4.00% AER. This suits those with stable pensions, but penalties apply for early withdrawal—up to 180 days’ interest loss.

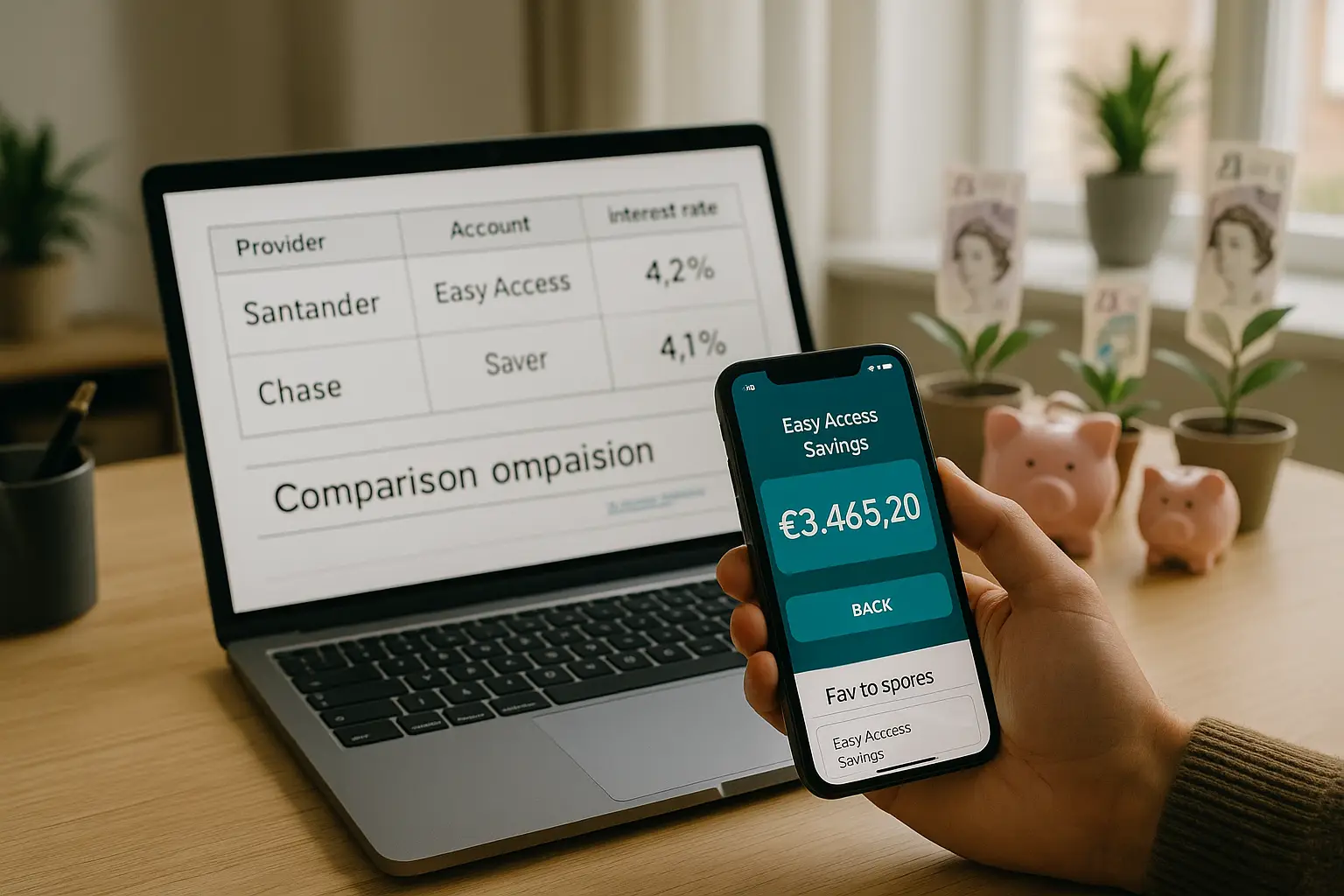

| Provider | Type | Rate (AER) | Min Deposit | Access |

|---|---|---|---|---|

| Nationwide | 1-year fixed | 4.27% | £500 | Branch/online |

| Leeds Building Society | 2-year fixed | 4.00% | £1,000 | Online |

| Halifax | 1-year fixed | 4.20% | £500 | Branch |

For detailed fixed options, explore the best cash isa fixed rates.

Best easy access and flexible cash ISAs

Easy access cash ISAs provide flexibility, with the best easy access cash ISA rates for over 60s at 4.51% AER. These allow withdrawals anytime, perfect for retirees facing variable costs.

Highest easy access rates

Providers on MoneySuperMarket offer up to 4.51% variable AER, with no notice required. Rates can change, so monitor via comparison sites.

Flexible options for emergencies

The best flexible cash ISA for over 60s, like those at 4.00% AER, lets you replace withdrawn funds within the year. This suits seasonal spending without losing interest.

Check current instant access deals in our article on the best cash isa instant access.

Expert tips from Martin Lewis and others

Martin Lewis recommends the best cash ISA rates for over 60s UK via MoneySavingExpert, emphasising transfers to top deals. For 2025/26, expect rates to hold around 4% amid steady base rates, but shop annually.

- Maximise your £20,000 allowance across types for diversified returns.

- Avoid low-rate legacy ISAs; transfer to the best cash ISA transfer rates for over 60s.

- Consider inflation—aim for real returns above 2%.

For transfer advice, see best cash isa transfer. Official rules are explained on MoneyHelper’s Cash ISAs page.

How to choose and open a cash ISA

Assess your needs: fixed for security or easy access for liquidity? Compare via trusted sites like moneyfactscompare.co.uk for the latest best cash ISA UK for over 60s.

Eligibility checks

UK residents aged 18+ qualify; over 60s face no special rules but benefit from tax perks. Confirm one ISA per tax year.

Application process

Apply online or in-branch; provide ID and proof of address. Transfers take 2-15 days.

Monitoring rate changes

Review quarterly, as rates follow economic shifts. Use alerts from providers.

Frequently asked questions

What is the best cash ISA for over 60s in the UK?

The best cash ISA for over 60s depends on needs, but top easy access from providers like those on MoneySavingExpert offer 4.51% AER for liquidity. Fixed options at 4.27% suit stable savers, as per moneyfactscompare.co.uk. Always check eligibility and FSCS protection to ensure suitability for retirement planning.

How much can over 60s save in a cash ISA tax-free?

Over 60s can save up to £20,000 annually in a cash ISA tax-free, the same allowance as all UK adults per MoneyHelper. This covers all interest earned, unlike taxable savings where only £1,000 is allowance-protected for basic rate taxpayers. Splitting across easy and fixed types maximises flexibility and growth.

Are there special cash ISAs for seniors?

No dedicated senior cash ISAs exist, but over 60s qualify for all standard ones with rates up to 4.45% tailored for their needs, as noted by money.co.uk. Providers like Nationwide offer branch access, easing application for less tech-savvy users. Focus on low-minimum, high-access options to match retirement lifestyles.

What are the risks of fixed-rate ISAs for pensioners?

Fixed-rate ISAs lock funds, risking penalties of 90-180 days’ interest for early withdrawal, problematic if unexpected costs arise for pensioners. Rates may underperform if market rates rise, per Martin Lewis warnings. However, they protect against drops, balancing risk for those with emergency funds elsewhere.

How do cash ISAs compare to regular savings for over 60s?

Cash ISAs offer fully tax-free interest, saving over 60s up to 20% on earnings compared to regular savings’ personal allowance limits. Rates align closely, around 4-4.5% AER, but ISAs cap at £20,000 yearly. For larger pots, combine both, ensuring FSCS coverage across accounts.

Which bank has the best cash ISA rates for over 60s?

High-street banks like Nationwide and Halifax lead with best cash ISA rates for over 60s nationwide at 4.20-4.27% for fixed terms, per their sites. Building societies like Leeds offer competitive easy access. Compare via independent tools for the highest, considering branch proximity for seniors.

What is the best fixed rate cash ISA rates for over 60s in 2025?

In 2025, the best fixed rate cash ISA rates for over 60s top 4.27% AER for one-year terms, ideal for locking in returns amid potential rate cuts. Longer two-year deals yield slightly less at 4.00%, suiting conservative strategies. Monitor updates on moneyfactscompare.co.uk to switch if better emerges without penalty.