What makes ISAs ideal for over 60s

For those over 60, finding the best isa rates for over 60s means prioritising tax-free growth and accessibility. Individual Savings Accounts (ISAs) allow up to £20,000 saved tax-free each tax year, shielding interest from income tax – crucial for retirees on fixed pensions. As of the 2025/26 tax year, this allowance remains unchanged, per Moneybox guidance.

Tax benefits for retirees

Retirees often face lower tax thresholds, making ISAs a shield against personal savings allowance limits. Interest earned in a Cash ISA is entirely tax-free, unlike regular savings where over £1,000 might be taxed for basic-rate taxpayers. This setup maximises returns without HMRC deductions, ideal for building a nest egg.

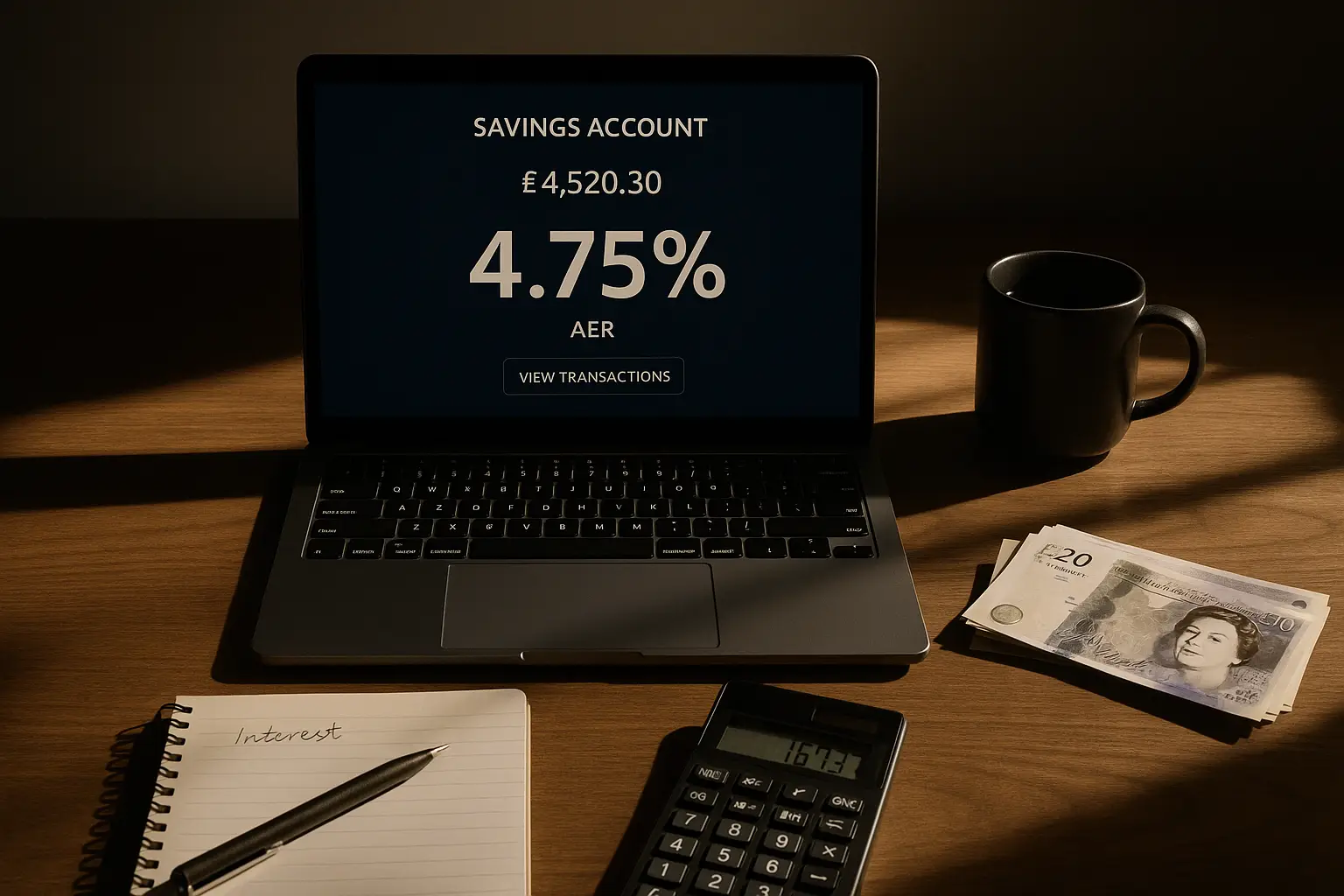

Key features to consider

Look for Annual Equivalent Rate (AER), which shows the true yearly return accounting for compounding. Minimum deposits range from £1 to £10,000, suiting various budgets. All UK ISAs offer FSCS protection up to £85,000 per institution, ensuring safety for seniors.

Common senior perks

Some providers offer no-penalty withdrawals or loyalty bonuses for over-60s, enhancing flexibility. Building societies like Nationwide provide member perks, while high street banks such as Halifax may waive fees for existing customers.

Top easy access cash ISA rates

The best easy access cash isa rates for over 60s currently top at 4.52% AER, allowing withdrawals anytime without notice. This liquidity suits retirees needing funds for unexpected expenses like healthcare.

Best providers and rates

Providers like those highlighted on MoneySavingExpert lead with competitive rates. For instance, selected easy access options reach 4.45% specifically tailored for seniors, as noted by money.co.uk.

Tip for seniors: Opt for easy access if you value flexibility over higher yields. Always check for 60-day notice periods that won’t penalise age-related needs.

Pros and cons for liquidity

Pros include instant access to funds and variable rates that can rise with Bank of England adjustments. Cons involve potentially lower rates than fixed options, averaging 0.5% less. For over 60s, this balance prevents locked savings during emergencies.

How to switch

Transferring is straightforward via providers’ online tools, preserving tax-free status. No penalties apply for easy access switches, and it takes about 10 working days.

Best fixed rate ISAs for guaranteed returns

For stability, the best fixed isa rates for over 60s offer 4.27% AER on one-year terms, locking in rates against falls. Fixed Cash ISAs suit those not needing immediate access.

One-year options

Top one-year fixed deals hit 4.27% AER, per moneyfactscompare.co.uk data from October 2025. Nationwide’s 1-year Fixed Rate Cash ISA at 4.00% AER includes loyalty incentives for seniors.

Two-year options

Longer terms yield slightly less at around 4.00% AER but provide certainty. Santander’s two-year fixed ISA is a solid choice, though verify senior eligibility.

| Provider | Rate (AER) | Min Deposit | Term |

|---|---|---|---|

| Nationwide | 4.00% | £1 | 1 year |

| Barclays | 3.85% | £500 | 1 year |

| Market leader | 4.27% | £10,000 | 1 year |

High street bank ISAs: Halifax and Nationwide reviewed

High street options like the best isa rates for over 60s halifax focus on familiarity and branch support.

Halifax rates and benefits

Halifax offers competitive easy access at around 4.00% AER, with app-based management for tech-savvy seniors. Benefits include no-fee transfers and FSCS cover.

Nationwide senior deals

Nationwide’s best isa rates for over 60s nationwide include 4.00% fixed, plus member bonuses. As a building society, it emphasises community perks for loyal over-60s customers.

Loyalty incentives

Both banks reward long-term savers with rate boosts, potentially adding 0.10% for seniors. Check for age-specific promotions quarterly.

Martin Lewis’s advice on ISAs for seniors

Martin Lewis, via MoneySavingExpert, recommends the martin lewis best isa rates for over 60s by prioritising top AERs and avoiding low-rate traps.

Top picks from MSE

MSE’s October 2025 guide highlights easy access at 4.52% and fixed at 4.28%. For cash-focused seniors, these outpace standard savings. Explore MoneySavingExpert’s best cash ISAs for updates.

Avoiding common pitfalls

Don’t exceed the £20,000 allowance or ignore rate drops post-introductory periods. Lewis advises annual reviews to maintain the best cash isa rates for over 60s uk.

2025 rate forecasts

With base rates steady, expect 4-4.5% persistence, but inflation may erode real gains. Link to broader insights on best isa rates and best isa rates fixed.

How to choose and open an ISA

Selecting the best isa rates for over 60s involves matching access needs with yields. Start by assessing your £20,000 limit, detailed at Moneybox’s ISA allowance guide.

Eligibility check

UK residents over 18 qualify; over 60s have no extra restrictions but benefit from perks.

Transferring existing ISAs

Use provider forms to move funds tax-free, targeting higher rates like 4.45% senior options from money.co.uk’s over-60s ISAs.

Monitoring rate changes

Rates fluctuate; review monthly. For fixed vs. easy access depth, see best isa rates easy access.

Frequently asked questions

What is the best ISA for over 60s in the UK?

The best isa rates for over 60s depend on needs, but top easy access Cash ISAs at 4.52% AER offer liquidity for retirees. Fixed options like Nationwide’s 4.00% suit those preferring stability. Always compare via trusted sites like MoneySavingExpert for the latest, as rates vary by provider and can change quickly.

Are there special ISA rates for seniors?

While no exclusive government rates exist for over 60s, providers offer senior-friendly features like bonus rates or flexible withdrawals. For example, some building societies add loyalty perks reaching 4.45%. These aren’t age-locked but target retirees; check eligibility to maximise tax-free benefits in 2025.

How much can over 60s save in an ISA tax-free?

Over 60s can save up to £20,000 annually tax-free, same as others, per HMRC rules for 2025/26. This covers all ISA types, with interest shielded from tax. Exceeding it requires non-ISA savings, potentially taxable; plan to split if needed for optimal returns.

What are Martin Lewis’s top ISA picks for over 60s?

Martin Lewis endorses high-AER Cash ISAs, like 4.52% easy access, for low-risk senior savings. He warns against low-rate banks, urging switches to leaders. For over 60s, his MSE picks emphasise flexibility and protection, forecasting steady rates; follow his updates for personalised strategies without risk.

What is the difference between fixed and easy access ISAs for retirees?

Fixed ISAs lock funds for terms like one year at 4.27% AER, guaranteeing returns but limiting access – risky for urgent retiree needs. Easy access allows anytime withdrawals at variable 4.52%, ideal for liquidity yet prone to rate drops. Seniors should balance based on spending patterns for best outcomes.

Can over 60s transfer ISAs without penalty?

Yes, transfers between providers are penalty-free and maintain tax-free status, taking up to 30 days. For easy access, it’s seamless; fixed may require waiting out terms. Over 60s benefit by moving to better rates like 4.45%, boosting yields – always confirm with the new provider first.

Note: Rates are as of October 2025 and subject to change. This is general information, not personalised advice; consult a financial advisor.