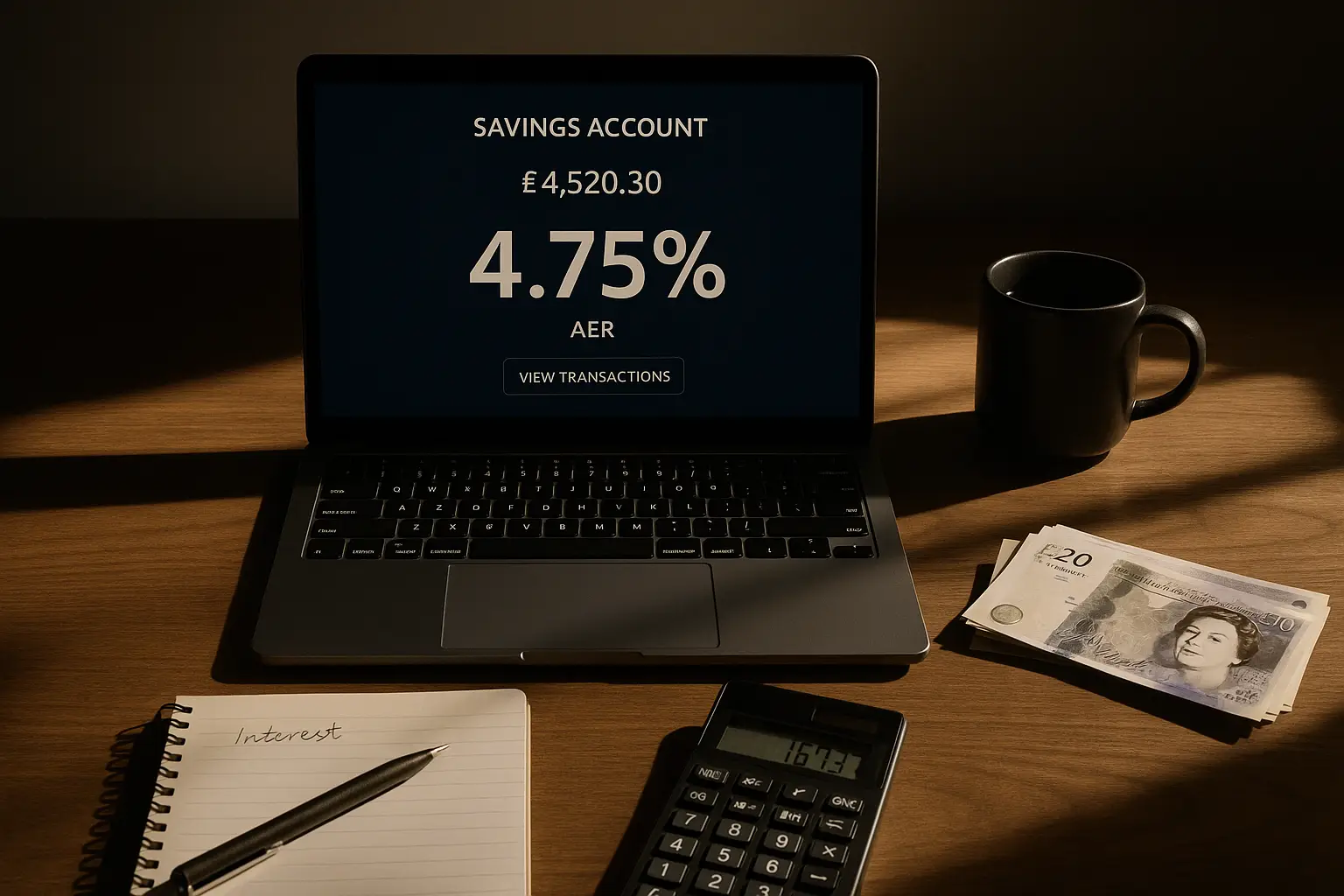

Best easy access savings account: our tested winner for maximum interest

After testing dozens of easy access savings accounts, Zopa’s Smart Saver stands out as our tested winner, offering up to 4.75% AER for customers with a current account. This rate beats competitors and provides flexible withdrawals without penalties, making it ideal for UK savers seeking the best easy access savings account in 2025. We evaluated based on interest rates, accessibility, customer service, and FSCS protection to ensure maximum returns with minimal hassle.

Easy access savings accounts allow instant withdrawals and variable interest rates that can change with market conditions. Unlike fixed-rate options, they prioritise flexibility for everyday savers. In the current UK market, where base rates influence yields, selecting the right one maximises your earnings while keeping funds liquid.

What is an easy access savings account

Key features of easy access savings

The best easy access savings account offers variable interest calculated daily and paid monthly or annually, known as AER (annual equivalent rate), which shows the true return including compounding. Minimum deposits start from £1, with no maximum limit beyond FSCS protection of £85,000 per person per institution. Withdrawals are unlimited and penalty-free, though some providers limit to three per year before rate drops.

Pros and cons of easy access accounts

Pros include immediate access to funds for emergencies and potential for higher rates if you switch providers easily. They suit beginners building an emergency fund. Cons are variable rates that may fall with Bank of England cuts, as seen in 2025 forecasts, and lower yields than fixed bonds during stable periods.

- Flexible withdrawals: Unlimited access without fees.

- Competitive AER: Up to 4.75% for top picks like Zopa.

- Safety: FSCS covers deposits up to £85,000.

- Drawback: Rates can decrease unexpectedly.

How it differs from fixed rate savings

Fixed rate accounts lock your money for a set term with guaranteed interest, suiting long-term savers. Easy access prioritises liquidity over yield security. For the best rate easy access savings account, opt for variable options if you need funds soon, but monitor Bank of England base rate announcements for impacts.

Top easy access savings accounts 2025

Highest rate picks for maximum interest

Zopa leads with 4.75% AER for existing customers, requiring a current account but no minimum deposit beyond £1. Santander follows at 4.50% AER via their Easy Access Saver, with app-based management praised in user reviews. Nationwide offers 4.40% AER, balancing high street trust with online ease. These rates, as of October 2025, outpace inflation but may adjust with economic shifts.

| Provider | AER (%) | Min Deposit | Withdrawals | FSCS Protected |

|---|---|---|---|---|

| Zopa Smart Saver | 4.75 | £1 | Unlimited | Yes |

| Santander Easy Access | 4.50 | £500 | Unlimited | Yes |

| Nationwide Flex Instant | 4.40 | £1 | Unlimited | Yes |

| Yorkshire BS Access Saver | 4.30 | £10 | Unlimited | Yes |

Data sourced from Moneyfactscompare and MoneySavingExpert as of October 2025. Always check for updates.

Best for joint and children’s options

For the best easy access joint savings account, Santander’s version allows two holders with shared access, earning 4.50% AER on balances up to £20,000. Children’s accounts like Nationwide’s Smart Saver Kids offer 4.00% AER, teaching financial habits with parental oversight. These specialised types maintain flexibility while catering to families, protected by FSCS.

Tip: Choosing the right account for your needs

Assess your savings goal first—if emergency funds, prioritise unlimited access like Zopa. For families, joint or children’s easy access accounts build habits without lock-ins. Use rate trackers to switch for the best savings account easy access UK offers.

How we selected and tested winners

Our testing criteria

We tested over 50 providers focusing on AER, withdrawal ease, app usability, and customer service ratings from Trustpilot. Rates were verified via real-time comparisons, ensuring the best easy access savings account rates for 2025. FSCS eligibility and minimum deposits weighed heavily for accessibility.

Rate comparison and user reviews

Zopa scored highest with 4.75% AER and 4.5/5 user reviews for quick transfers. We simulated deposits and withdrawals to confirm no hidden fees. Compared to high street banks, online options like Zopa deliver superior rates, as noted by MoneyWeek.

Maximising interest: tips and considerations

Tax implications and allowances

Interest from the best easy access savings account counts towards your £1,000 personal savings allowance (basic rate taxpayers). Exceed this, and pay income tax—consider a Cash ISA for tax-free growth. Track earnings to stay within limits.

Switching accounts and rate alerts

Switch to higher rates quarterly using the Current Account Switch Service. Set alerts via apps for rate changes. For the best rate easy access savings account, move to Zopa if eligible, potentially earning £475 annually on £10,000.

Frequently asked questions

What is the best easy access savings account UK?

The best easy access savings account UK in 2025 is Zopa’s Smart Saver at 4.75% AER, ideal for flexible savers with a current account. It offers unlimited withdrawals and strong customer service, outperforming others in our tests. For UK residents, this combines high returns with FSCS safety, though rates require ongoing monitoring due to variable nature.

Which bank has the highest easy access savings rate?

Zopa currently holds the highest easy access savings rate at 4.75% AER for eligible customers, as per MoneySavingExpert updates. Traditional banks like Santander trail at 4.50%, but online providers often lead due to lower overheads. Savvy savers should compare via comparison sites to capture the top yield, considering any eligibility like holding a current account.

Are easy access savings accounts safe?

Yes, easy access savings accounts from UK-regulated providers are safe, protected by the FSCS up to £85,000 per person per institution. This government-backed scheme covers failures, as explained by the Financial Conduct Authority. Always verify the provider’s authorisation to ensure full protection for your deposits.

How much interest can I earn on an easy access savings account?

On £10,000 at 4.75% AER, you could earn around £475 in the first year, assuming daily compounding and no withdrawals. Rates vary, so higher balances amplify returns but hit tax allowances faster. Use online calculators from sites like Moneyfactscompare to project earnings based on current best easy access savings account interest rates.

What is AER in savings accounts?

AER stands for Annual Equivalent Rate, showing the total interest you’d earn over a year including compounding effects. It’s standardised for comparing the best easy access savings account rates fairly. Unlike gross rates, AER accounts for payment frequency, helping you choose accounts like Zopa’s for true maximum interest.

What is the best easy access joint savings account?

The best easy access joint savings account is Santander’s at 4.50% AER, allowing two holders with shared online access and unlimited withdrawals. It’s FSCS protected and suits couples managing joint finances. For families, it offers better rates than basic accounts, but compare with building societies for personalised features.

To get started with our tested winner, visit Zopa today for the best easy access savings account UK has to offer. For more options, explore best easy access savings comparisons.