Understanding ISA basics for 2025

The best ISA rates 2025 offer tax-free savings opportunities up to £20,000 per tax year, helping UK savers maximise returns amid fluctuating interest rates. A Cash ISA is a tax-efficient savings account where interest earned remains free from income tax, ideal for those seeking security without market risks. For the 2025/26 tax year, running from 6 April 2025 to 5 April 2026, the ISA allowance stays at £20,000, as confirmed by official HMRC data from GOV.UK, allowing you to shelter savings from taxation while rates hover around 4.5% AER for top options.

What is a Cash ISA?

A Cash ISA functions like a regular savings account but with tax-free interest, protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). It suits conservative savers prioritising capital preservation over higher-risk investments. Unlike stocks and shares ISAs, Cash ISAs provide guaranteed returns based on the provider’s interest rate, making them a cornerstone for building emergency funds or short-term goals.

2025/26 tax year allowance and rules

Your total ISA contributions cannot exceed £20,000 across all ISA types in the 2025/26 tax year, with unused allowance not carried over. Rules permit transfers between providers without affecting your limit, but withdrawals count against future contributions if not careful. Always check eligibility; UK residents aged 18+ qualify, and the average ISA value reached £34,044 in 2024/25, up 2.3% year-on-year per GOV.UK statistics.

Types of ISAs: Cash vs fixed vs easy access

Cash ISAs include easy access for flexibility, fixed-rate for locked-in security, and notice accounts for balanced access. Easy access suits frequent withdrawals with rates around 4.52% AER as of October 2025 from MoneySavingExpert, while fixed options guarantee up to 4.28% AER for one or two years according to Which?. Choose based on your liquidity needs—easy access for unpredictability, fixed for stability.

Best easy access Cash ISA rates October 2025

Top easy access Cash ISA rates hit 4.52% AER in October 2025, providing liquidity without penalties for the best ISA rates UK 2025 seekers. Providers like Coventry Building Society lead, offering competitive yields for everyday savers.

Top providers and current AERs

Reliable options include:

- Coventry Building Society at 4.52% AER (variable, min £1 deposit).

- Yorkshire Building Society at 4.45% AER (easy access, FSCS protected).

- Leeds Building Society at 4.40% AER (no notice required).

These rates, sourced from Moneyfactscompare’s daily updates up to 4.51% AER, beat standard savings by keeping interest tax-free. Note: Rates can change; verify latest figures.

| Provider | Rate (AER) | Min Deposit | Withdrawal Access |

|---|---|---|---|

| Coventry Building Society | 4.52% | £1 | Unlimited |

| Yorkshire Building Society | 4.45% | £10 | Unlimited |

| Leeds Building Society | 4.40% | £100 | Unlimited |

Pros and cons of flexibility

Easy access ISAs allow instant withdrawals, perfect for emergencies, but rates may drop with Bank of England cuts—forecasted lower by year-end per expert analysis. Pros include no lock-in and FSCS safety; cons involve variable yields trailing fixed options long-term. For best cash ISA rates UK July 2025 trends, rates peaked at 4.60% before easing.

How to switch for better rates

Switching is straightforward via provider-backed transfers, preserving tax-free status. Use tools from MoneySavingExpert to compare, and complete within 15 days to avoid gaps. Link to our guide on best isa rates easy access for step-by-step advice.

Top fixed rate ISAs for 2025

Fixed rate ISAs lock in the best fixed ISA rates 2025 at up to 4.28% AER for stability, shielding against rate drops through 2026. Ideal for medium-term savers planning ahead.

1-year vs 2-year options

One-year terms yield 4.20% AER on average, versus 4.28% for two years, per Which? data. Shorter terms offer quicker access but lower returns; longer suits if rates forecast to decline. Santander’s two-year fixed ISA exemplifies at competitive levels.

Leading rates from banks and building societies

Standouts:

- Santander: 4.25% AER (1-year, min £500).

- Yorkshire Building Society (YBS): 4.28% AER (2-year, online only).

- Halifax: 4.15% AER (1-year, branch access).

These provide guaranteed interest, with YBS options detailed on their site. For more, see best isa rates fixed.

Lock-in considerations

Penalties apply for early withdrawal, often 90-180 days’ interest lost. Weigh against easy access if funds might be needed; fixed suits lump sums like bonuses. Rates as of October 2025 from Moneyfactscompare.

Specialised ISAs: Junior, Lifetime, and over 60s

Niche ISAs tailor to life stages, with best junior ISA rates 2025 at 4.0% AER and Lifetime ISAs boosted by 25% government bonuses. Over-60s options often match standard rates with added perks.

Best Junior ISA rates

Junior Cash ISAs from Coventry at 4.0% AER help parents save tax-free for children under 18. Allowance is £9,000 annually; interest compounds until maturity at 18.

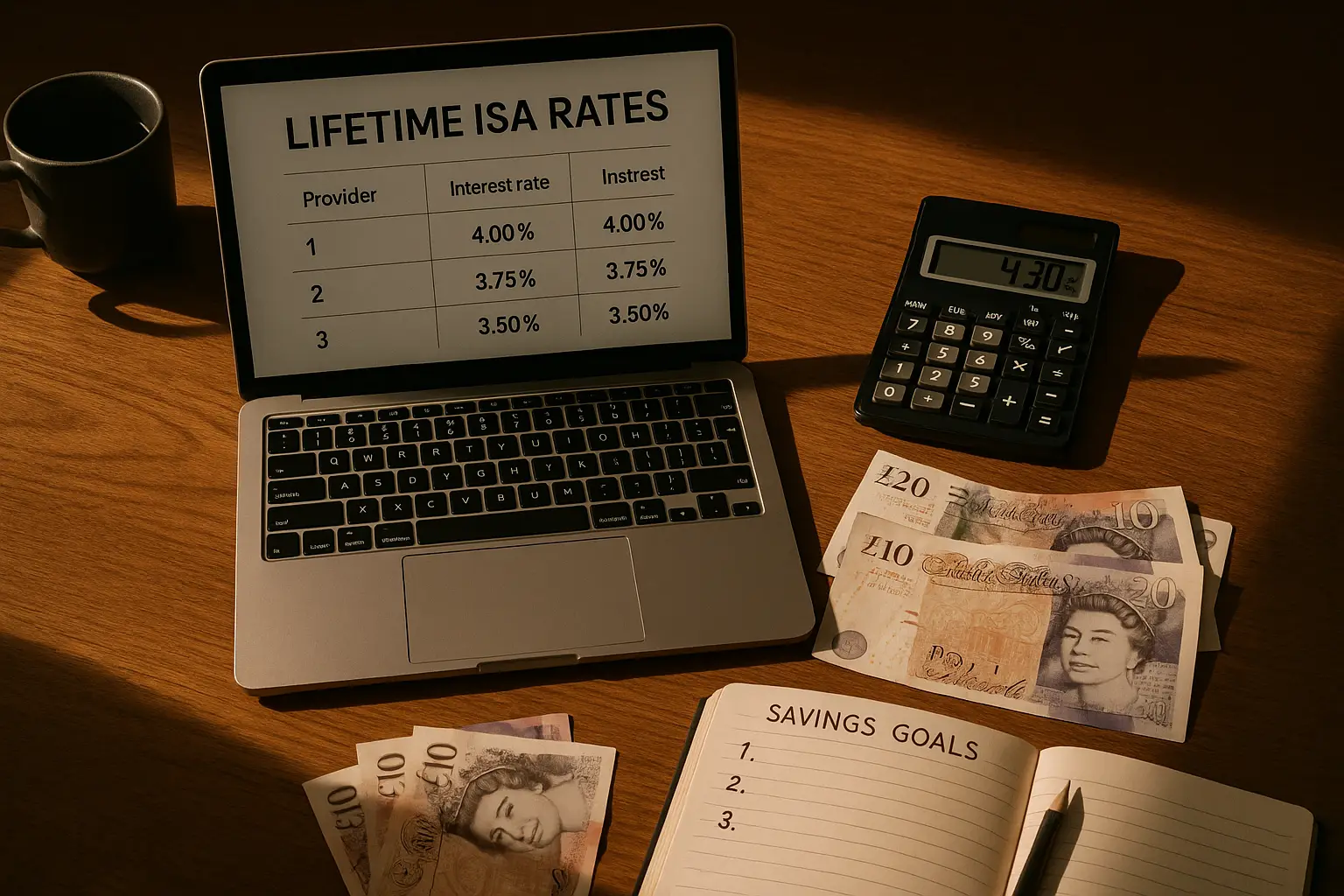

Lifetime ISA bonuses and rates

Lifetime ISAs offer 4.1% AER plus a 25% bonus on up to £4,000 yearly for 18-39-year-olds buying homes or retiring. 87,250 withdrew for properties in 2024/25 per GOV.UK, maximising gains. Check best isa rates for broader comparisons.

Senior-friendly options

For over 60s, best ISA rates 2025 for over 60s mirror top yields like 4.50% from building societies, often with no-minimum deals. No special boosts, but eligibility aligns with standard rules; explore demographic tweaks via best isa rates for over 60s.

How to choose and apply for the best ISA in 2025

Prioritise AER, access, and provider stability for the best ISA interest rates 2025; compare via independent sites like Moneyfactscompare.

Factors affecting rates

Base rate influences yields—expect slight drops post-2025 cuts. Inflation at 2% erodes real returns, so aim above it. Martin Lewis from MoneySavingExpert advises shopping around for martin lewis best isa rates.

Eligibility and tax benefits

UK residents qualify; tax-free interest saves up to 45% for higher earners. Transfers maintain benefits without new allowance use.

Monitoring rate changes

Rates shift monthly—July 2025 saw peaks, August dips per Moneyfacts. Use alerts from providers; revisit annually before tax year-end.

Frequently asked questions

What is the highest ISA rate available in 2025?

The highest easy access Cash ISA rate stands at 4.52% AER as of October 2025, offered by select building societies like Coventry. This tops fixed options at 4.28% AER, providing tax-free growth on up to £20,000. However, these are variable and subject to market changes; always confirm with providers for the latest best cash ISA rates 2025.

Can I transfer my existing ISA for better 2025 rates?

Yes, you can transfer Cash ISAs to providers offering higher rates without using your £20,000 allowance, as long as it’s done correctly via the new provider. This process typically takes 15 working days and preserves tax-free status. For strategies, consider seasonal peaks like best cash ISA rates UK September 2025; consult GOV.UK guidelines to avoid penalties.

Are ISA rates expected to change by end of 2025?

ISA rates may decline towards late 2025 due to anticipated Bank of England base rate cuts, potentially dropping easy access yields below 4%. Fixed rates could hold steady for new savers, but existing ones remain locked. Track via MoneySavingExpert for forecasts, balancing with inflation for real returns on your best fixed cash ISA rates 2025.

What’s the difference between AER and gross interest on ISAs?

AER (Annual Equivalent Rate) shows the effective yearly return accounting for compounding, making comparisons accurate across providers. Gross interest is the raw rate before tax, but in ISAs, it’s all tax-free so AER simplifies choices. Beginners should prioritise AER for apples-to-apples views on best ISA rates for 2025, as it reflects actual growth on balances.

How does the ISA allowance work for 2025/26?

The £20,000 allowance applies from 6 April 2025, covering all ISA types combined, with no carryover to next year. You can split it across Cash, stocks, or Lifetime ISAs, but over-contributions incur 40% tax penalties. This structure encourages tax-efficient planning; for families, Junior ISAs add separate £9,000 limits per child.

What are the best fixed rate ISAs for 1 year?

Top 1-year fixed ISAs offer 4.20-4.25% AER from Santander and YBS, locking in for stability amid rate uncertainty. These suit savers avoiding volatility, with minimum deposits from £500. Compare pros like guaranteed returns against cons like withdrawal fees; Which? ratings highlight FSCS protection for security in 2025.