Finding the best savings account uk for maximum returns in 2025

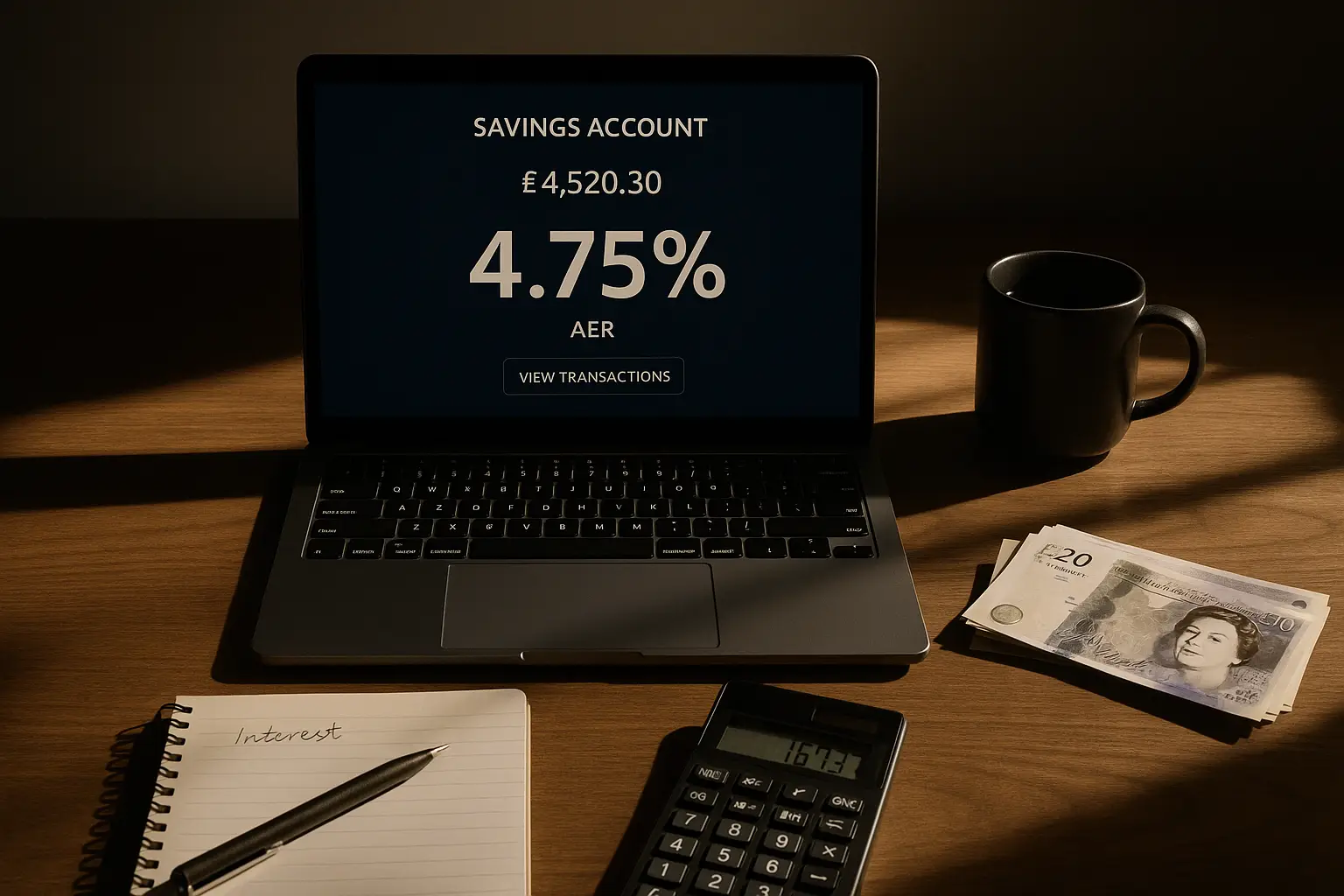

The best savings account uk in 2025 offers up to 4.5% AER for easy access options, allowing savers to grow their money securely while maintaining flexibility. With interest rates influenced by the Bank of England’s base rate, top accounts from providers like those highlighted by MoneySavingExpert outperform the average 3% AER, providing a real opportunity to beat inflation. This guide compares key types to help you select the ideal option based on your needs, whether for liquidity or higher yields.

Annual Equivalent Rate (AER) represents the total interest earned over a year, assuming compound interest, making it a standard measure for comparing savings accounts. Factors like minimum deposits and withdrawal rules vary, but all recommended accounts are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). For the latest on best savings account options, consider your savings goals first.

Top easy access savings accounts 2025

Easy access savings accounts provide the highest liquidity in 2025, with top rates at 4.5% AER, ideal for emergency funds or short-term needs without penalties for withdrawals.

Highest rates and providers

The leading easy access account is from a provider offering 4.5% AER with no minimum deposit, as per MoneySavingExpert’s October 2025 survey. Other strong contenders include options at 4.4% AER from online banks, surpassing the market average and suitable for balances over £1,000.

Pros and cons

- Pros: Instant access to funds, variable rates that can rise with market changes, FSCS protection.

- Cons: Rates may drop if base rates fall, lower yields than fixed options.

For those seeking the best easy access savings account uk, prioritise accounts with no notice periods.

Best fixed rate savings accounts

Fixed rate savings accounts lock in rates up to 4.55% AER for one year, perfect for lump sums where predictability trumps flexibility.

Terms and comparisons

A one-year fixed bond at 4.55% AER from Moneyfacts-listed providers edges out longer terms like two years at 4.2% AER, due to current yield curve trends. Minimum deposits start at £500, with no withdrawals allowed until maturity.

| Provider | AER (%) | Min Deposit | Access Type |

|---|---|---|---|

| Example Bank A | 4.5 | £1 | Easy Access |

| Example Bank B | 4.55 | £500 | 1-Year Fixed |

| Example Bank C | 7.5 | £200/month | Regular Saver |

Suitability for lump sums

These accounts suit savers with £10,000+ who can commit funds, offering better returns than easy access but with penalty risks for early exit. Check best fixed rate savings account uk updates for daily changes.

Tip: Maximising returns

Switch to a fixed rate if you anticipate rate cuts in 2025, but keep some funds in easy access for emergencies. Use tools from MoneySavingExpert to track eligibility.

High-interest regular saver options

Regular savings accounts yield up to 7.5% AER for monthly deposits up to £200, rewarding disciplined savers with the highest rates available.

Deposit rules and top picks

Top accounts require consistent deposits without withdrawals, limited to 12 months, as detailed by MoneySavingExpert’s regular savings guide. Providers like building societies offer these, often exclusive to current account holders.

The best savings account rates in this category beat easy access but cap total savings at £2,400 annually.

Specialized accounts for children, joints and ISAs

For families, the best child savings account uk reaches 5% AER with parental control, while joint accounts share protection up to £170,000 combined.

Child and joint recommendations

Child accounts from providers like NatWest offer tax-free growth under the parent’s allowance, ideal for gifts. Joint options enhance yields for couples, with rates mirroring standard accounts.

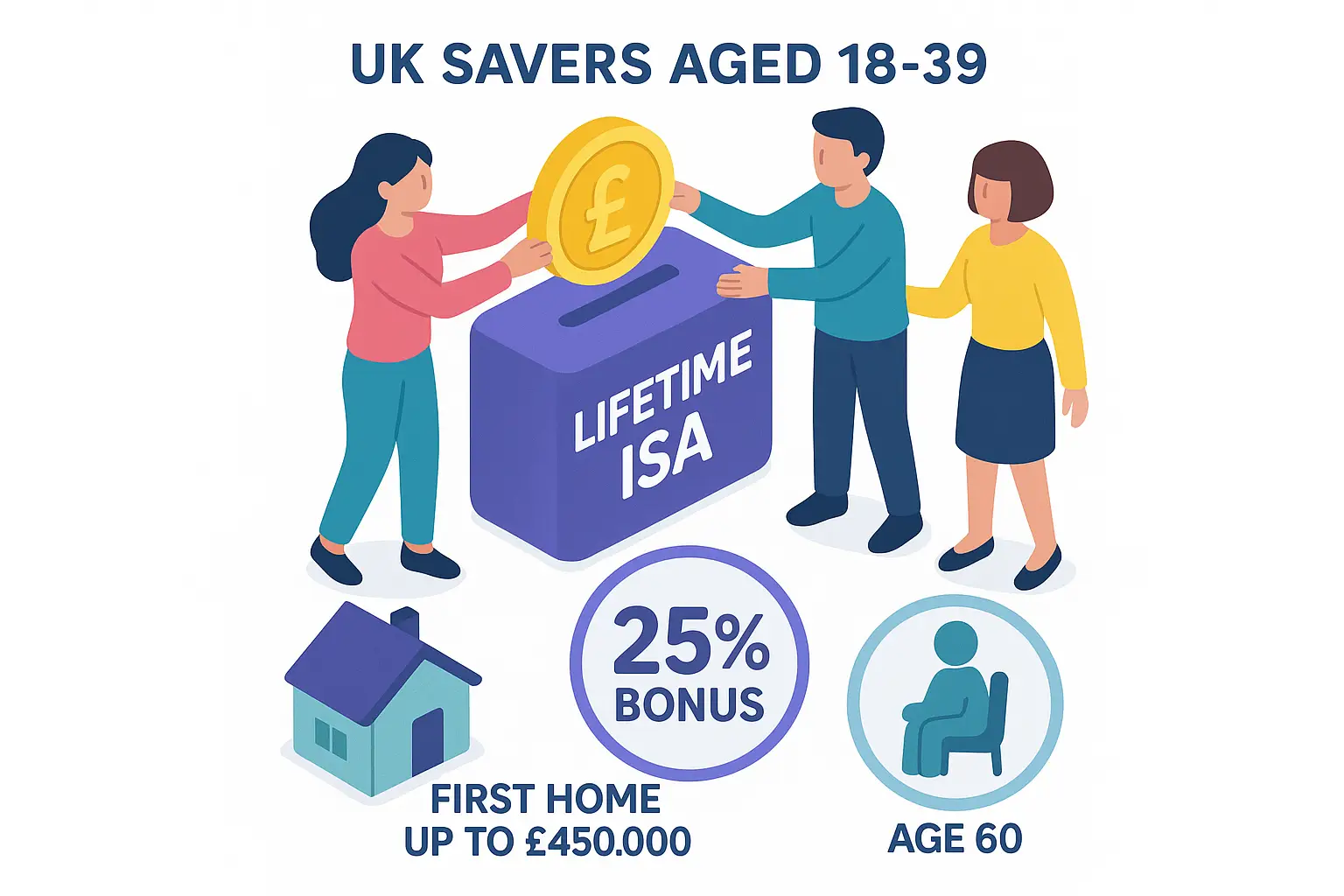

Tax-free ISA savings

Cash ISAs provide up to £20,000 allowance at 4.3% AER, exempt from tax. Explore best isa savings account uk for sheltered returns, especially if over the personal savings allowance.

How to choose the best savings account uk

Select based on access needs, deposit size and tax status; top picks prioritise AER above 4% with FSCS cover for safety.

Safety and protection

All UK-regulated accounts are FSCS-protected up to £85,000 per person, ensuring funds are safe even if a provider fails, as confirmed by Which?. Diversify across institutions for larger sums.

Tax implications and 2025 predictions

The personal savings allowance permits £1,000 tax-free interest for basic-rate taxpayers; exceed it and consider ISAs. With base rates potentially stable at 4.75% in 2025 per Bank of England forecasts, rates may hold but monitor for cuts. Learn more about FSCS protection for peace of mind.

Frequently asked questions

What is the best easy access savings account UK 2025?

The top easy access savings account UK 2025 offers 4.5% AER with unlimited withdrawals and no minimum balance, making it ideal for flexible saving. Providers update rates frequently, so compare via sites like Moneyfacts for the latest. This type suits those needing quick access without sacrificing competitive returns, though rates can fluctuate with economic changes.

How much interest can I earn on savings UK?

On a £10,000 balance in the best high interest savings account uk at 4.5% AER, you could earn around £450 annually, compounded. Earnings depend on the account type and your deposit amount, with regular savers potentially doubling that for smaller monthly inputs. Always calculate using AER to get an accurate projection, and remember variable rates may adjust.

Are savings accounts safe in the UK?

Yes, savings accounts from authorised UK providers are protected by the FSCS up to £85,000 per person, safeguarding against bank failure. This government-backed scheme covers deposits in authorised institutions, but check for international branches. For added security, spread savings across multiple banks if over the limit.

What is the best child savings account UK?

The best child savings account UK in 2025 provides up to 5% AER with easy access, often through junior ISAs for tax-free growth until age 18. These accounts encourage family saving habits, with low or no minimums and parental oversight. Compare options from Which? for features like bonuses on regular deposits to maximise long-term benefits.

How does the personal savings allowance work?

The personal savings allowance lets basic-rate taxpayers earn £1,000 interest tax-free yearly, higher-rate £500, and zero for additional-rate. It applies to non-ISA savings, so track earnings to avoid unexpected tax bills via HMRC. For strategies to stay within limits, consider shifting to tax-free ISAs if your interest exceeds the allowance.

What are the best savings account rates UK for 2025?

Best savings account rates UK for 2025 top 4.55% for fixed terms and 7.5% for regular savers, per MoneySavingExpert updates. These outperform averages but require matching your saving style—flexible or locked. Expert advice from Martin Lewis emphasises switching providers annually to capture peaks, potentially boosting returns by 1-2%.

Word count: 812