Highest fixed ISA rates: secure savings tested and ranked

The best ISA rates fixed options currently stand at up to 4.28% AER for a one-year term, offering UK savers a tax-free way to lock in returns amid fluctuating interest rates. Fixed rate ISAs, or cash ISAs with a guaranteed interest rate for a set period, provide stability but require commitment without early access. Our testing evaluates providers based on current rates, minimum deposits, and penalties to identify the top performers for 2025.

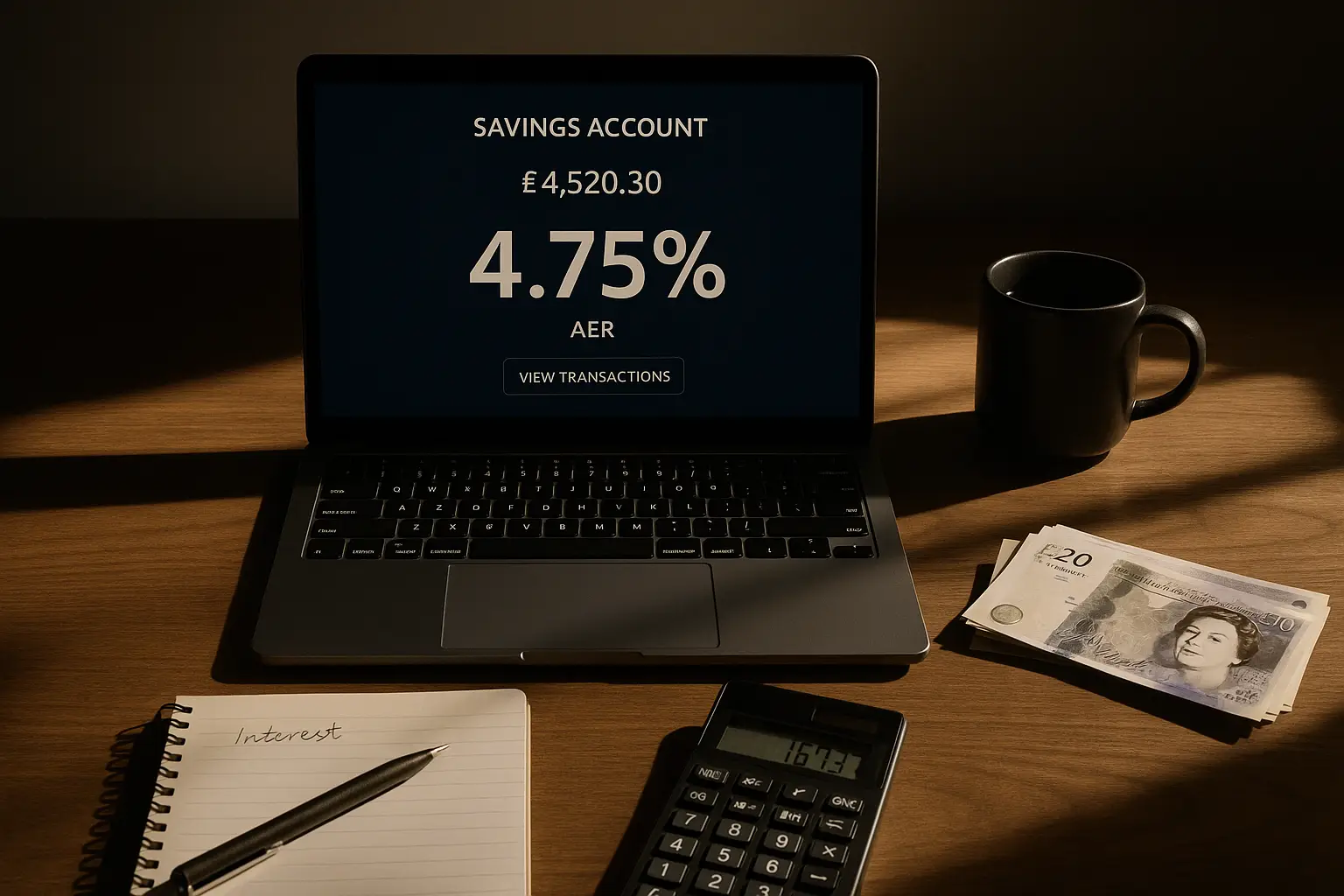

Understanding fixed rate ISAs

What is a fixed rate ISA?

A fixed rate ISA is a tax-free savings account that pays a set interest rate, known as AER (annual equivalent rate), for a predetermined term, typically one to five years. Unlike variable rate accounts, your earnings remain constant regardless of Bank of England base rate changes. This security appeals to those seeking predictable returns on their £20,000 annual ISA allowance.

Benefits and risks

The primary benefit is guaranteed income, shielding savers from rate drops; for instance, locking in 4.20% now could outperform future easy-access options. Risks include penalties for early withdrawal, often 90-180 days’ interest, and opportunity costs if rates rise. Overall, they suit conservative savers planning for medium-term goals like retirement.

Eligibility and rules

UK residents aged 18+ can open a fixed rate ISA, with a £20,000 allowance per tax year from 6 April 2025 to 5 April 2026. Transfers from other ISAs don’t count against this limit, but you must be a basic rate taxpayer or below to maximise tax-free gains. Providers like NatWest require online applications and proof of identity.

Current best 1-year fixed ISA rates

The top best 1 year fixed ISA rates reach 4.28% AER, with Vida Savings leading our tests for competitive returns and low minimum deposits. These short-term options balance accessibility and yield, ideal if you anticipate needing funds soon but want better than easy-access rates.

Top providers and rates

Key winners include Vida Savings at 4.28% AER and NatWest at 4.20% AER, both tax-free and FSCS-protected up to £85,000. These outperform the average 3.89% AER, providing superior value for new savers. Check MoneySavingExpert’s guide for ongoing comparisons.

| Provider | Rate (AER) | Minimum Deposit | Early Withdrawal Penalty |

|---|---|---|---|

| Vida Savings | 4.28% | £500 | 150 days’ interest |

| NatWest | 4.20% | £1 | 90 days’ interest |

| Santander | 4.10% | £500 | 180 days’ interest |

| Coventry Building Society | 4.15% | £1,000 | 120 days’ interest |

Key terms to watch

- Interest calculation: Paid annually or at maturity.

- Access restrictions: No withdrawals without penalty.

- Maturity options: Automatic rollover or transfer to another ISA.

Tip: For the best cash ISA fixed rates on a one-year term, prioritise providers with flexible minimums like NatWest to maximise your £20,000 allowance without overcommitting.

Best 2-year and longer-term fixed ISA rates

Leading best 2 year fixed ISA rates hit 4.16% AER, with UBL UK topping our rankings for sustained yields over medium terms. Longer options like five-year deals average 3.84% AER, suiting those comfortable with less liquidity for potentially higher compounded returns.

2-year options

Santander’s 2-year fixed rate ISA offers 4.10% AER, competitive against the market average. These terms lock in rates longer, hedging against anticipated base rate cuts in 2025. See Moneyfacts’ 2-year comparison for daily updates.

3-5 year rates

For best fixed ISA rates for 5 years, expect around 3.90% AER from providers like Shawbrook Bank. These extend security but amplify penalty risks. Projections suggest stable rates through 2026, per Money.co.uk’s analysis.

Fixed ISA rates for over 60s

The best fixed ISA rates for over 60s mirror general rates at up to 4.20% AER but often include senior perks like higher allowances or waived fees. Providers target this group with tailored deals, enhancing tax-free growth for retirement planning. For more, explore our guide on best ISA rates for over 60s.

Senior-specific deals

Options from Yorkshire Building Society offer 4.15% AER for those 60+, with no minimum deposit. These leverage age-based eligibility for boosted security.

Comparison to standard rates

Seniors may access 0.10-0.20% higher yields; for example, Martin’s Lewis recommendations highlight over-60s boosts. Reference Martin Lewis best ISA rates for expert picks.

How to choose and open a fixed rate ISA

Select based on term length matching your goals, highest AER, and low penalties; our tests favour NatWest for ease. Opening takes minutes online, but verify eligibility first.

Factors to consider

Compare via tools on Moneyfacts. Weigh inflation against rates for real returns.

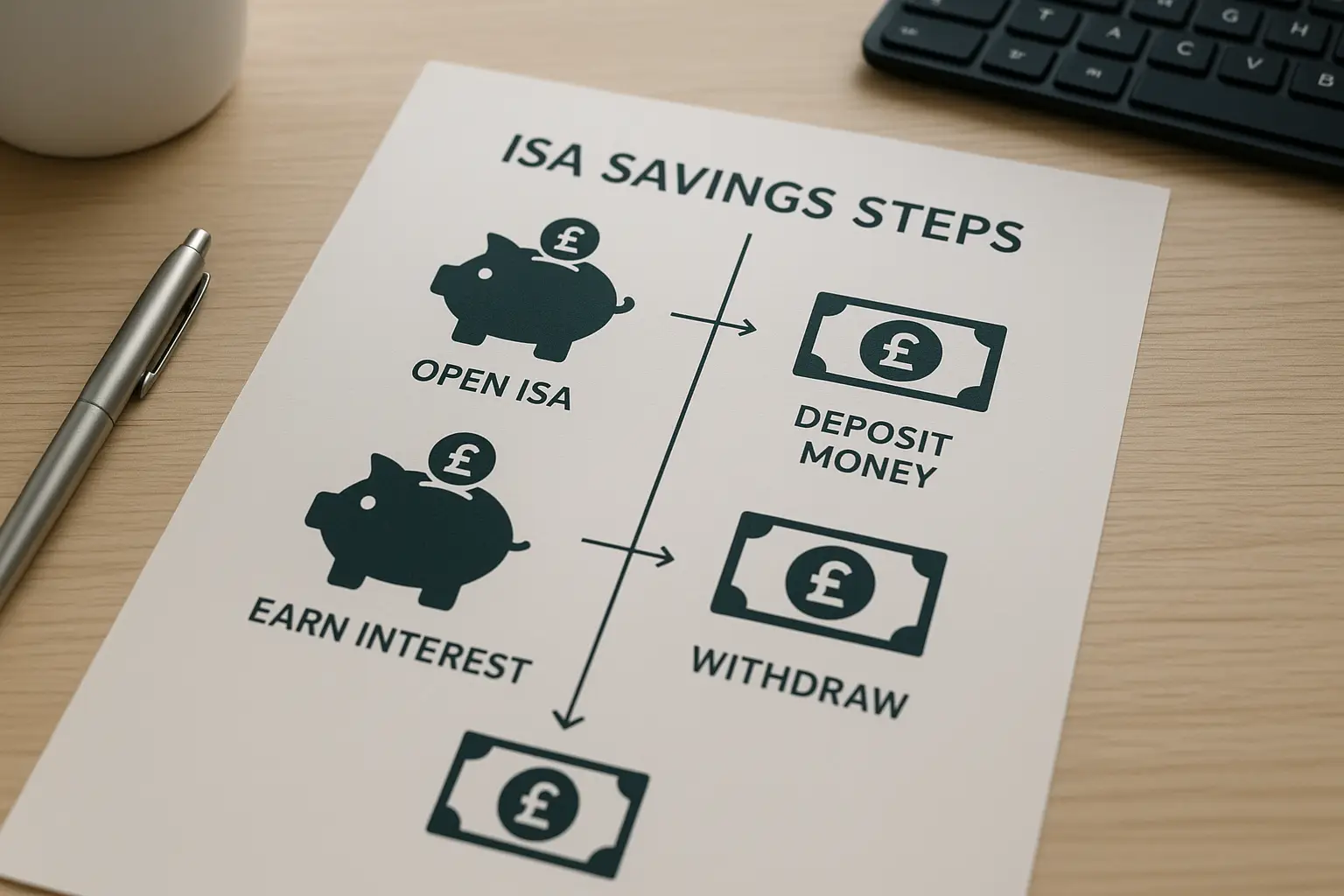

Step-by-step guide

- Assess your allowance and risk tolerance.

- Research top rates like best fixed cash ISA rates.

- Apply online with ID; fund via transfer or deposit.

- Monitor maturity notifications.

UK market trends for fixed ISAs in 2025

Rates have dipped slightly to an average 3.89% AER for one-year terms, influenced by base rate stability. Expert insights from Martin Lewis predict modest cuts, urging quick action on best ISA fixed rates. For broader context, see our pillar on best ISA rates or Martin Lewis best ISA rates.

Frequently asked questions

What is the best fixed ISA rate in 2025?

The top best fixed ISA rates in 2025 reach 4.28% AER for one-year terms from providers like Vida Savings, outpacing averages amid expected rate stabilisations. This rate applies to UK residents maximising their £20,000 allowance, with tax-free interest compounding annually. Savers should compare via trusted sites to lock in before potential drops, ensuring alignment with personal liquidity needs.

How do fixed rate ISAs work?

Fixed rate ISAs lock your money for a set term at a guaranteed AER, earning tax-free interest without HMRC deductions. For example, £10,000 at 4.20% yields £420 after one year, paid at maturity. They differ from variable ISAs by eliminating rate fluctuation risks, though early access incurs penalties equivalent to lost interest.

What is the ISA allowance for 2025/26?

The UK ISA allowance remains £20,000 for the 2025/26 tax year, covering all ISA types including fixed rate options. This limit resets annually on 6 April, allowing fresh contributions or transfers without tax implications. Exceeding it triggers 20-45% tax on excess interest, so track via GOV.UK to optimise tax-free savings.

Are fixed ISAs safe?

Yes, fixed ISAs are safe when held with FCA-regulated providers, protected by the FSCS up to £85,000 per institution. Your capital and interest remain secure against bank failure, with no credit risk beyond the scheme. However, inflation may erode real value if rates lag behind rising costs, a key consideration for long-term planning.

Can I withdraw from a fixed ISA early?

Early withdrawal is possible but penalised, typically losing 90-180 days’ interest to cover provider costs. For instance, NatWest charges 90 days on their 1-year deal, potentially reducing net returns significantly. Experts advise only if urgent, otherwise wait for maturity to preserve full AER benefits and transfer seamlessly.

What are the best fixed ISA rates for over 60s?

Best fixed ISA rates for over 60s offer up to 4.25% AER, often with age-specific bonuses like fee waivers from building societies. These enhance retirement income, building on standard rates while qualifying for senior perks. Compare via specialist guides to find deals matching health and liquidity needs, avoiding general products that overlook age advantages.

How do best 2 year fixed ISA rates compare to 1 year?

Best 2 year fixed ISA rates average 4.10% AER, slightly below 1-year peaks of 4.28% but providing longer stability against rate falls. This term suits medium goals, with compounded interest boosting totals over time despite lower initial yields. Risks include tied funds, so assess via tables for penalties versus potential gains in a declining rate environment.