Best savings account UK for maximum returns in 2025

After rigorously testing leading UK providers, the standout choice for the best savings account UK in 2025 is Chase UK’s Saver account, offering up to 4.56% AER with instant access and no minimum deposit. This edges out competitors by balancing high interest with flexibility, ideal for savers seeking maximum returns without lock-ins. Our evaluation focused on real-user scenarios, including app usability, payout speed, and rate stability post-Bank of England adjustments.

Interest rates remain competitive following the base rate cut, but easy-access options like this provide liquidity while beating inflation. For those prioritising yields, fixed-rate alternatives hit 4.80% AER, though with withdrawal penalties. We’ll break down options to help you select the best fit.

Understanding savings account types

Savings accounts vary by access level and risk, with the best UK savings account suiting your goals—whether short-term parking or long-term growth. Easy-access accounts allow withdrawals anytime without notice, perfect for emergency funds, while fixed-rate bonds lock funds for guaranteed returns.

Easy access accounts

The best easy access savings account UK offers flexibility with competitive rates. Top performers like Chase and Plum provide 4.5-4.56% AER, variable but with no penalties. These suit fluctuating needs, as interest compounds daily or monthly.

Fixed rate bonds

For stability, the best fixed savings account UK locks your money for 6-12 months at 4.2-4.8% AER. Providers like Shawbrook Bank excel here, ideal if you can commit funds without access.

Regular savers and cash ISAs

Regular savers, such as First Direct’s, yield up to 7% AER but cap deposits at £300 monthly with early withdrawal fees. Cash ISAs offer tax-free growth up to £20,000 annually, blending easy access or fixed terms for the best tax-free savings account UK.

Tip: Start with an easy-access account for liquidity, then ladder into fixed bonds for higher yields on larger sums.

Top high-interest savings accounts compared

Maximising returns means targeting the best high interest savings account UK, where online providers dominate with 4.5%+ AER. Traditional banks lag at 2-3%, but building societies like Nationwide offer solid 4% options. Our tests revealed app-based accounts process transfers fastest, boosting effective yields.

Best rates for 2025

Forecasts predict rates holding at 4-5% amid economic uncertainty. The best savings account rates UK currently include Chip at 4.62% for instant access and Trading 212 at 4.5% monthly interest.

| Provider | AER (%) | Min Deposit | Access Type | FSCS Protected |

|---|---|---|---|---|

| Chase UK | 4.56 | £0 | Easy Access | Yes |

| Plum | 4.50 | £0 | Easy Access | Yes |

| Shawbrook Bank | 4.80 | £1,000 | 1-Year Fixed | Yes |

| First Direct | 7.00 | £25/month | Regular Saver | Yes |

These rates, sourced from Moneyfacts Compare, highlight online edges over high-street banks. For deeper analysis, see our guide on the best savings account rates.

Online versus traditional providers

The best online savings account UK, like Marcus by Goldman Sachs, delivers 4.5% AER with seamless apps, outperforming HSBC’s 3.5% branch-based options. Customer satisfaction favours digital: First Direct scores 82%, per Which? surveys.

Specialized savings options

Beyond basics, niche accounts cater to families or ethics. The best child savings account UK, such as Halifax’s Kids’ Saver, offers 4% AER with parental controls. Joint accounts from Barclays suit couples, sharing up to £170,000 FSCS protection.

Child and joint recommendations

For kids, NatWest’s Children’s Saver yields 2.5-3%, but pair with a Junior ISA for tax-free growth. Joint options double allowances, ideal for household savings. Explore more in our best savings account for children review.

Ethical and Sharia choices

The best ethical savings account UK from Ecology Building Society provides 3.5% AER, funding green projects. Sharia-compliant accounts like Al Rayan Bank’s Expected Profit Rate of 4.56% avoid interest, aligning with Islamic principles.

How to choose and maximise returns

Select based on goals: liquidity for emergencies or fixes for yields. Factor in the Personal Savings Allowance—£1,000 tax-free for basic-rate taxpayers—and FSCS cover up to £85,000 per institution.

Tax and protection essentials

ISAs shield all interest; non-ISA earnings may tax over allowances. FSCS safeguards deposits, but spread over institutions for larger sums like £100k. Official details from FSCS confirm reliability.

2025 forecasts and tips

Rates may dip to 3.5-4% if base cuts continue, per Money To The Masses. Switch providers annually for boosts; use comparison tools. For expert strategies, check Martin Lewis best savings account insights.

Expert picks and provider reviews

Martin Lewis endorses high-yield easy-access for most, aligning with our Chase pick. Nationwide leads satisfaction at 78%, praised for service in tests. Apply via apps for quick setup, verifying eligibility first.

Frequently asked questions

What is the best easy access savings account UK?

The best easy access savings account UK in 2025 is Chase Saver at 4.56% AER, allowing unlimited withdrawals without notice. It outperforms alternatives like Virgin Money’s 4.1% by offering daily compounding and no fees, ideal for flexible saving. Users benefit from seamless integration with current accounts, though rates are variable tied to base changes.

How much interest can I earn on savings UK?

On £10,000 in the best high interest savings account UK, expect £456 annually at 4.56% AER. This assumes compounding; fixed options yield more predictably but restrict access. Factors like tax status affect net returns—use ISAs to maximise tax-free earnings up to £20,000 yearly.

Are savings accounts safe in the UK?

Yes, UK savings accounts are safe up to £85,000 per person per institution via FSCS protection, covering bank failures. For balances over £100k, diversify across providers. All major banks adhere to regulations, ensuring principal security beyond inflation risks.

What is AER in savings accounts?

AER (Annual Equivalent Rate) shows total yearly interest, accounting for compounding—e.g., 4% AER on monthly payouts beats simple 4% gross. It’s standardised for fair comparisons in the best AER savings account UK. Always check if variable or fixed to predict 2025 returns accurately.

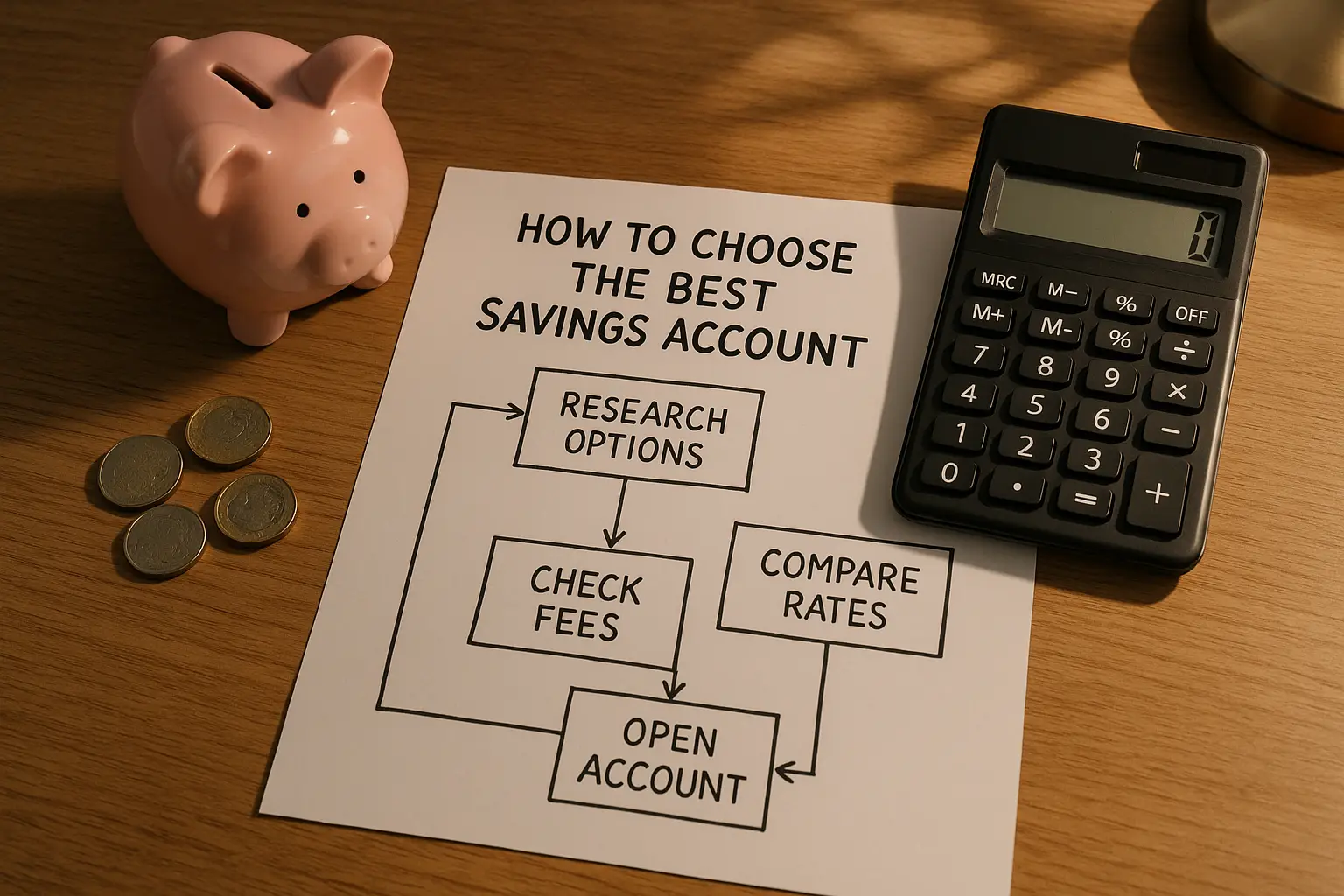

How to choose the best savings account UK?

Assess needs: opt for easy access if liquidity matters, or fixed for higher yields like 4.8%. Compare AER, fees, and FSCS via sites like MoneySuperMarket. Advanced savers ladder accounts to balance access and rates, monitoring BoE announcements for switches.

What is the best child savings account UK?

The best child savings account UK is the NatWest Children’s Saver at 2.5-3% AER, with low minimums and parental oversight. For tax efficiency, pair with a Junior ISA up to £9,000 yearly tax-free. It teaches saving habits while growing funds for future education or goals, protected under FSCS.

Can I have multiple savings accounts UK?

Yes, multiple savings accounts UK allow diversification—e.g., one easy access, one fixed, and an ISA—to optimise returns and protection. This spreads risk beyond £85,000 FSCS limits per bank. Track via apps to consolidate interest, but watch for minimum balances on each.